As the oil and gas sector comes to terms with decade-low oil prices and global disruptions caused by the coronavirus (COVID-19), company costs and investments are being slashed with more than US$50bn pledged to date and more on the horizon, according to GlobalData

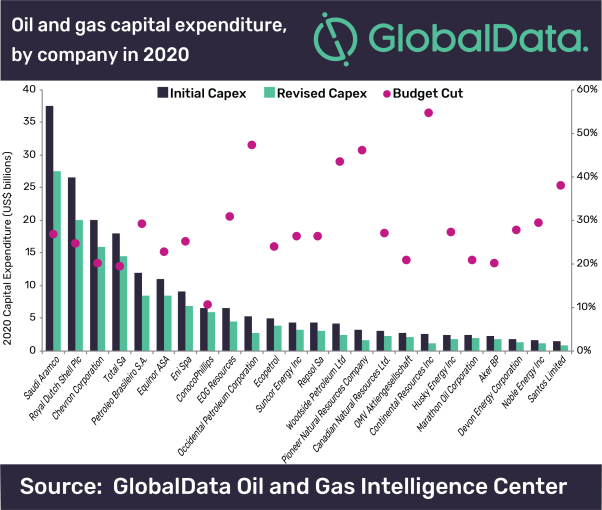

Daniel Rogers, oil and gas analyst at GlobalData, commented, “Of the announced US$50bn in cuts to date, approximately 20 per cent of that is coming solely from Saudi Aramco, which could have implications for its ongoing expansion projects in the country. Elsewhere, across the supermajors, the investment cuts are within the 20-25 per cent range, resulting in multibillion dollar pull backs in new projects and non-critical investments.”

GlobalData has calculated that the average announced capital expenditure (CAPEX) cut for 2020 currently sits at 29 per cent from original forecasts. On the higher end of the spectrum, US operators with significant shale acreage and Australian operators with imminent large-scale liquified natural gas (LNG) projects have taken the most drastic reduction measures. While the US operators such as EOG Resources and Occidental Petroleum cut down on rig counts, Australian players Woodside Petroleum and Santos are opting to defer LNG projects until investment conditions improve.

Rogers continued, “We have yet to see companies such as Exxon Mobil and BP release budget cut estimates, but based on what we have seen already it is highly likely a further US$10bn could be taken off the table in 2020.”

Regained market stability at sustainable levels is required to bring back delayed spending and investment confidence. In addition to deferred project investments, share buy backs, dividend pay-outs and general overhead costs have all come under review for 2020 with revisions downward.